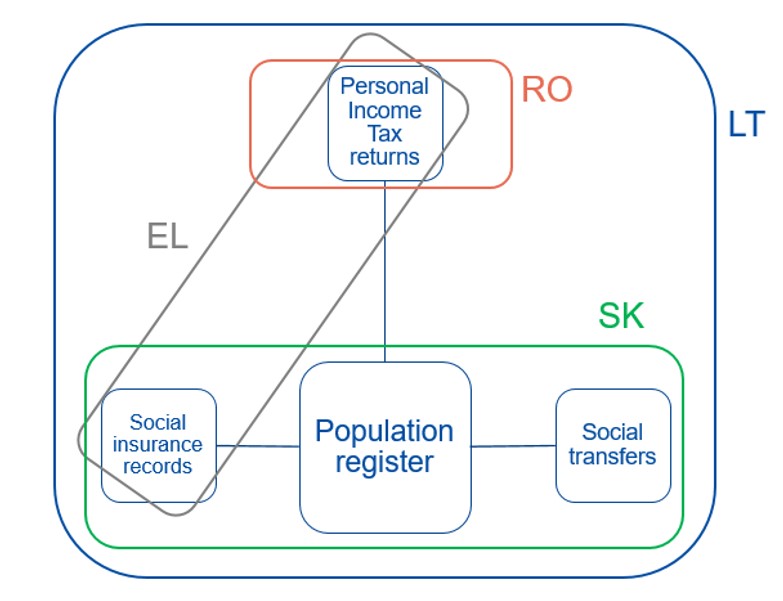

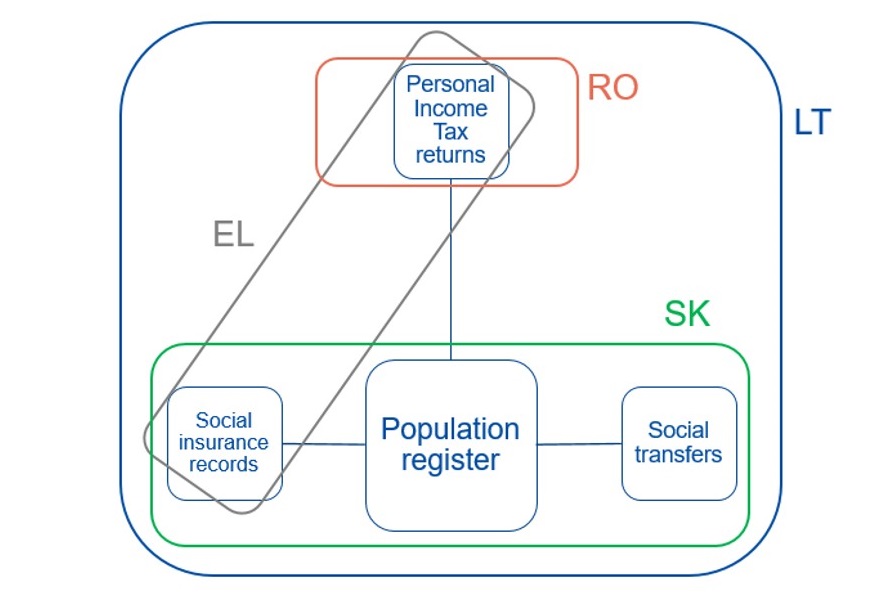

Since 2017, JRC has been collaborating with DG REFORM (previously SRSS) in delivering technical support to member states regarding microsimulation and the use of administrative data for assessing tax-benefit reforms. In particular, the use of administrative data was foreseen for four countries: Greece, Lithuania, Slovakia and Romania. Details and status of each project follow. The project for Greece was developed with the Council of Economic Advisors (SOE) of the Greek Ministry of Finance. It involved the creation of two alternative EUROMOD input datasets based on 2018 and 2020 tax returns (2017 and 2019 incomes respectively). Both present a similar structure to the previously available 2015 dataset , but the sample design is different: it contains all the households in the top 1% of the income distribution, and it is sampled in a way that the same observations are followed across years, making possible to build a panel. More recently SOE received six new datasets (three for 2017 and three for 2019), with information about social insurance contributions paid by employees, employers and self-employed/farmers. All datasets contain information related to the individuals whose tax returns are part of the tax samples. These datasets have been thoroughly tested and incorporated to the master version of EUROMOD using a country-specific extension (switch). The most distinct feature of the new spine is the simulation of imputed income, a very relevant feature in the Greek PIT. It consists in imputing an income to all taxpayers, based on objective costs of living, ownership of assets and some real expenses. If imputed income is higher than declared income, the difference is also taxed with specific rules. All these rules had not been simulated in EUROMOD until now due to lack of information in the SILC-based input data. The version of EUROMOD running with administrative data has been used by both JRC and SOE in the assessment of the distributional and budgetary impact of several policy reforms: the introduction of a birth grant, the impact of the Social Dividend, the taxation of imputed income and the reforms enacted in the context of the Enhanced Surveillance Framework (property tax and personal income tax). Since September 2020 JRC has been working with the Slovak Council for Budget Responsibility (CBR/RRZ) on the adaptation of administrative data to be used in SIMTASK, CBR’s in-house model which is compatible with EUROMOD in terms of data. In particular, JRC and RRZ have merged a sample of the population register with seven datasets from the Central Office of Labour, Social Affairs and Family (parental allowance, child benefit, child birth grant, child care allowance, foster care allowance, funeral benefit, disability benefit) and four from the social insurance agency (paid social insurance contributions, pensions, unemployment benefits and sickness benefits). Besides the very rich information on benefits, the resulting EUROMOD input dataset contains very detailed information on employment income and labour history, which will make possible to accurately simulate contributory benefits in a second phase of the project. The resulting model, named TATRASK, is being used already by RRZ. The project on the use of administrative data in Lithuania has been a joint work of JRC and the Lithuanian Ministries of Finance and of Social Security and Labour. The objective was the creation of a EUROMOD input dataset using several administrative sources from the Education Management Information System. The sources included census data and tax declarations referring to the year 2019. Moreover, the project involved the adjustment of the EUROMOD model to run with the administrative input data, using a new country-specific extension. The administrative dataset will be used together with EUROMOD by the two Lithuanian ministries for the monitoring and evaluation of tax and benefit reforms. In the case of Romania only personal income tax returns will be available. The information contained is more limited than for Greece, so the objective is to build a tax calculator based on the EUROMOD platform.