EUROMOD Online provides a simplified access to EUROMOD, with the objective of making it accessible to a wider audience. Main uses include research, policy analysis and teaching, but it is open to any citizen interested in understanding the impact of tax-benefit reforms across EU countries. If you want to have access, click on the Sign in/Register button above and fill in the form. You will need an EU Login account; in case you don't have one, you will be able to easily create it during the registration process.

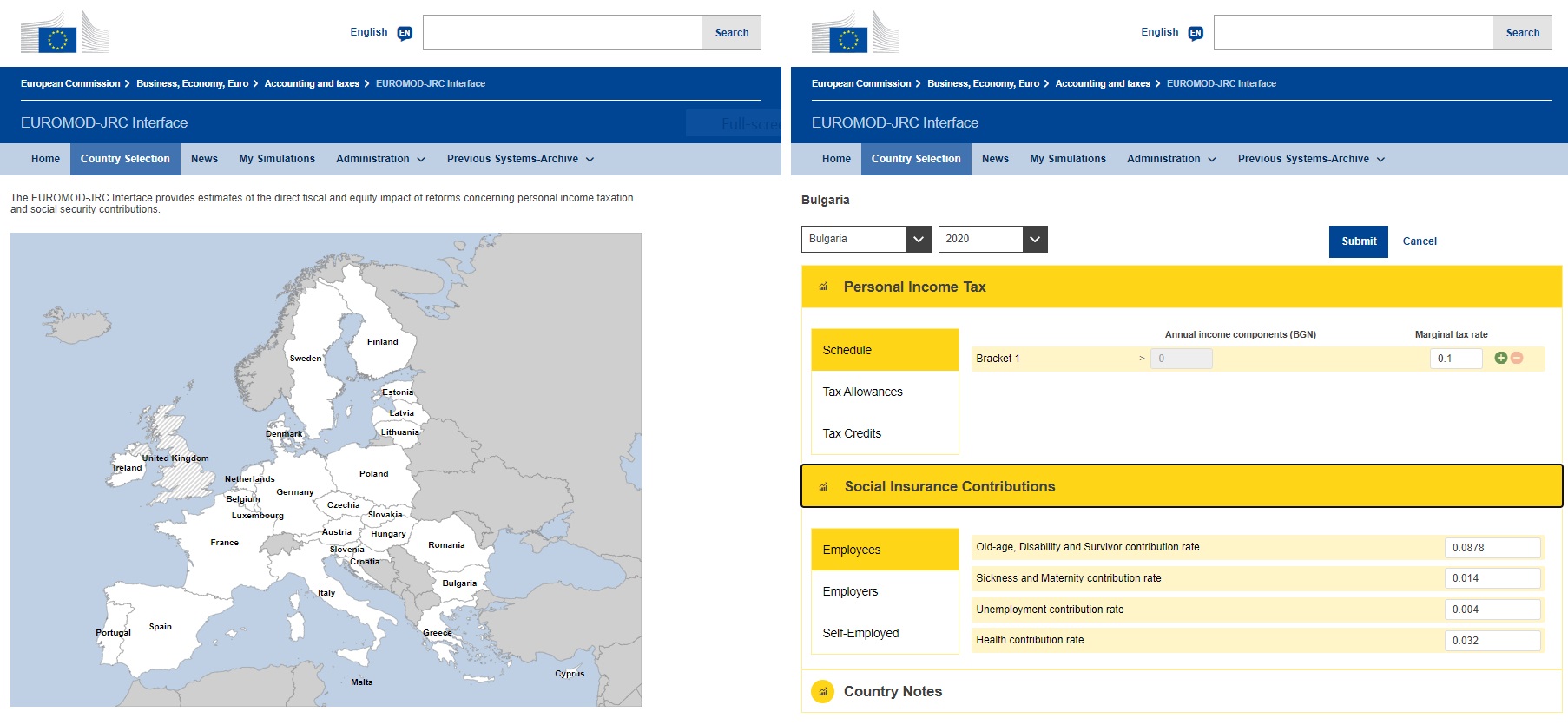

EUROMOD Online, in its current form, allows the user to simulate non-complex reforms on Personal Income Taxes (PIT) and Social Insurance Contributions (SIC) for all EU member states. Additionally, it allows to simulate parametrical reforms of family-related benefits for Austria, Greece, Italy and Spain. The rest of the countries will be gradually added in the forthcoming months.

Simulations can be run on either standard SILC-based EUROMOD input data or on a set of pre-defined hypothetical households. Besides the arithmetical calculations (morning-after effect), it is also possible to estimate medium-term effects using parameters from a VAR model (Barrios et al., 2022).

More information about EUROMOD Online and its scope can be found in the EUROMOD Online Manual and in the EUROMOD Online country-specific notes. The tool is under continuous development, with the aim of improving users' experience and provide them with additional simulation options and indicators. For any question or suggestion do not hesitate to contact us at JRC-EUROMOD-ONLINE.